sales tax calculator buffalo ny

65 100 0065. New York State Sales Tax.

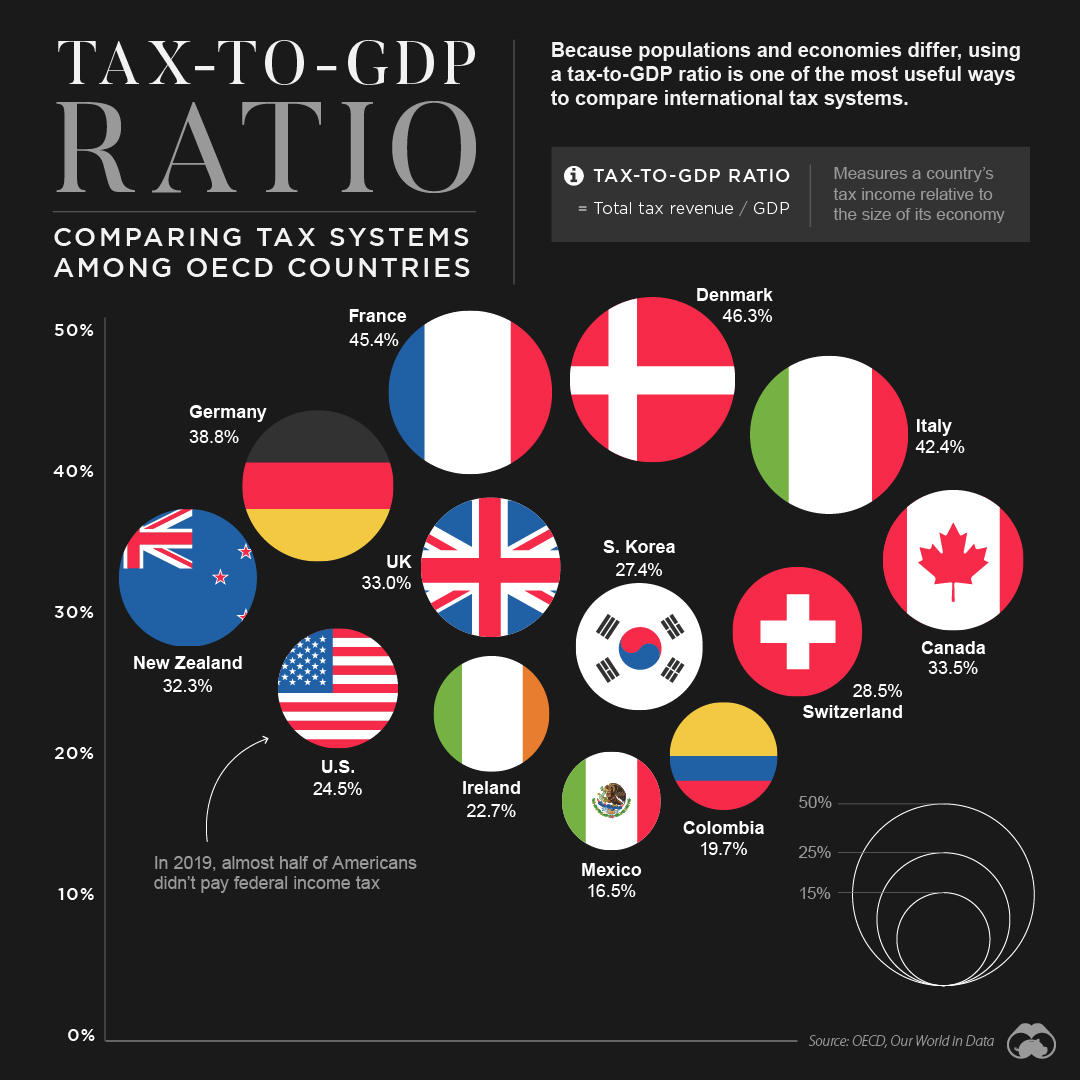

Tax To Gdp Ratio Comparing Tax Systems Around The World

You can use our New York Sales Tax Calculator to look up sales tax rates in New York by address zip code.

. Average Local State Sales Tax. Senior Financial Tax. The Erie County New York sales tax is 875.

List price is 90 and tax percentage is 65. Overview of New York Taxes. Sales Tax Calculator.

The calculator will show you the total sales tax amount as well as the. Multiply price by decimal. The sales tax rate in Erie County New York is 875.

Divide tax percentage by 100. Sales Tax Calculator in Buffalo NY. For a more detailed breakdown of rates please refer to our.

Pursuant to the New York State Real Property Tax Law The Department of Assessment and Taxation is responsible for the implementation of a fair and equitable. 875 Is this data incorrect Download all New York sales tax rates by zip code. Name A - Z Sponsored Links.

If youre an online business you can connect TaxJar directly to your shopping cart. Real property tax on median. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

Sellers pay a combined NYC NYS Transfer Tax rate of 2075 for sale prices of 3 million or more 1825 for sale prices above 500k and below 3 million and 14 for sale prices of. Sales Tax State Local Sales Tax on Food. This is the total of state county and city sales tax rates.

Name A - Z Sponsored Links. The recently enacted New York State budget suspended certain taxes on motor fuel and diesel motor fuel effective June 1 2022. The December 2020 total local sales tax rate was also 8750.

The minimum combined 2022 sales tax rate for Buffalo New York is. Maximum Local Sales Tax. Before-tax price sale tax rate and final or after-tax price.

Sales Tax Calculator in Buffalo NY. New Yorks estate tax is based on. Maximum Possible Sales Tax.

The price of the coffee maker is 70 and your state sales tax is 65. Ester Guylas Tax Service Inc. Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase.

This includes the rates on the state county city and special levels. The Buffalo New York sales tax rate of 875 applies to the following 29 zip codes. New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status.

Sales tax applies to retail sales of certain tangible. The New York sales tax rate is currently. New York Estate Tax.

Sales tax is calculated by multiplying the. You can also use our New York property tax calculator to find out what you would pay in property taxes in New York. The current total local sales tax rate in Buffalo NY is 8750.

New York Sales Tax Rates By City County 2022

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Buffalo New York Ny Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

How Much Are Closing Costs In Buffalo Ny Hunt Real Estate

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

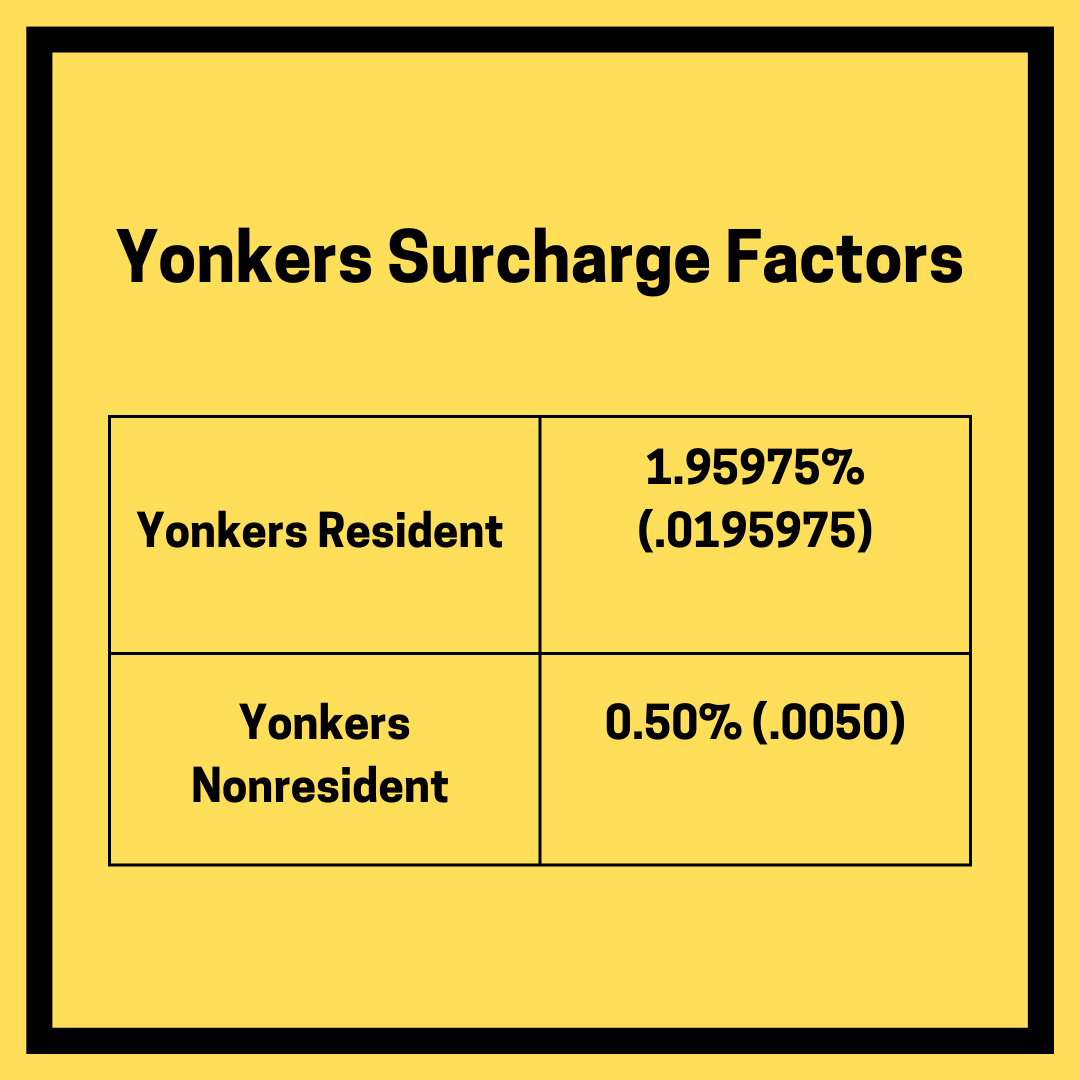

A Complete Guide To New York Payroll Taxes

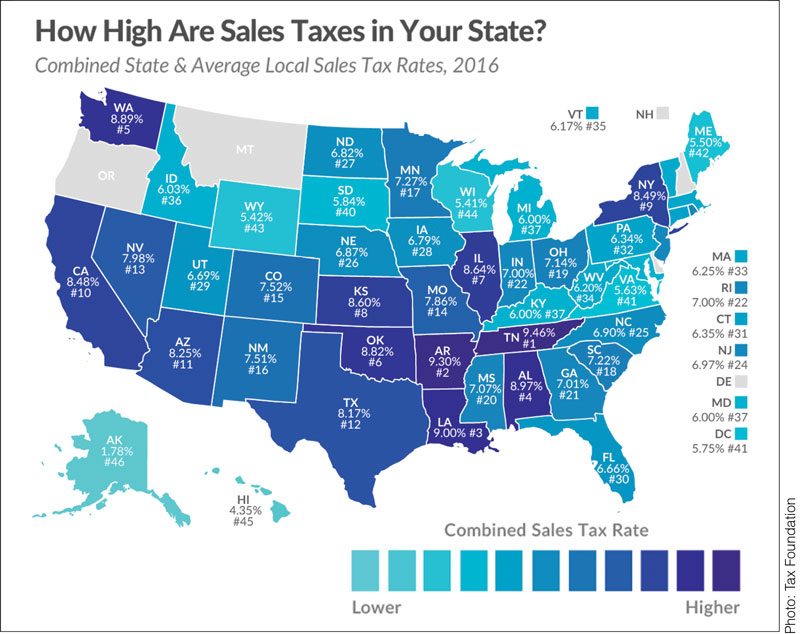

How To Charge Your Customers The Correct Sales Tax Rates

Avoid Penalties By Staying Aware Of Sales Tax Laws

How To Charge Your Customers The Correct Sales Tax Rates

How To Calculate Sales Tax 99designs

How To Charge Your Customers The Correct Sales Tax Rates

Nebraska Sales Tax Rates By City County 2022

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

The New York Pass Through Entity Tax Election Freed Maxick

What Are The Taxes On Selling A House In New York

New York Sales Tax For Photographers Bastian Accounting For Photographers